Delving into Mezzanine Debt Explained: How Hybrid Financing Works for Businesses, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Mezzanine debt is a versatile financing option that sits between traditional bank loans and equity financing. It offers businesses a flexible way to raise capital without immediately diluting ownership, making it an attractive choice for companies looking to fuel growth and expansion.

Introduction to Mezzanine Debt

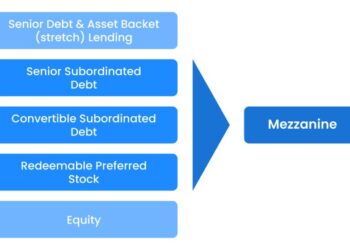

Mezzanine debt is a type of financing that sits between senior debt and equity in the capital structure of a company. It is often used by businesses to fund growth, acquisitions, or other strategic initiatives. Unlike traditional bank loans, mezzanine debt typically has a higher interest rate and may include equity-based features such as warrants or conversion rights.

When Mezzanine Debt Makes Sense

- When a company is looking to expand but does not want to dilute existing ownership by issuing more equity.

- In situations where traditional bank financing is not sufficient to meet the capital requirements of a business.

- For companies with strong cash flow but limited hard assets to use as collateral for a secured loan.

Benefits and Risks of Mezzanine Debt

- Benefit: Provides access to a larger pool of capital than traditional bank loans.

- Benefit: Can be structured with flexible repayment terms to align with the company's cash flow.

- Risk: Higher interest rates and fees compared to senior debt, increasing the cost of capital for the business.

- Risk: In case of default, mezzanine lenders have the right to convert their debt into equity, diluting existing shareholders.

Strategic Use of Mezzanine Debt

Mezzanine debt can be a strategic choice for a growing company that wants to maintain control and ownership while accessing additional capital for expansion. By leveraging mezzanine financing, a business can accelerate growth, make acquisitions, or fund other value-creating initiatives without giving up a significant stake in the company.

Structure and Features of Mezzanine Financing

Mezzanine financing is a unique form of hybrid financing that combines elements of debt and equity. This type of financing is often used by businesses looking to fund growth opportunities, acquisitions, or buyouts. Understanding the structure and features of mezzanine financing is crucial for businesses considering this option.

Typical Structure of Mezzanine Financing

Mezzanine debt sits between senior debt and equity in the capital structure. It is considered subordinated debt, meaning it ranks below senior debt in terms of repayment priority. Mezzanine lenders typically receive both interest payments and a share of the company's equity.

Repayment of mezzanine debt is usually structured with a bullet payment at maturity, although some arrangements may include periodic payments. Security for mezzanine debt is often in the form of a pledge of assets or a lien on the company's equity.

Comparison with Traditional Bank Loans and Equity Financing

In comparison to traditional bank loans, mezzanine financing offers more flexibility in terms of repayment and may be able to provide a larger amount of capital. On the other hand, mezzanine debt is more expensive than bank loans due to its higher risk profile.

Compared to equity financing, mezzanine debt allows businesses to retain ownership and control while still accessing additional capital. However, mezzanine lenders typically require a higher return on investment than equity investors.

Key Features of Mezzanine Financing

Mezzanine financing is attractive to businesses due to its flexibility in repayment terms and its ability to provide a significant amount of capital without diluting ownership. Additionally, mezzanine lenders are often more willing to take on higher risk than traditional lenders, making this form of financing accessible to companies with limited assets or operating history.

Case Study: How Mezzanine Debt Helped a Company Achieve Financial Goals

Company XYZ, a growing tech startup, was looking to expand its operations but lacked the necessary capital. By securing mezzanine financing, Company XYZ was able to fund its expansion plans without giving up a significant portion of ownership. The mezzanine debt allowed the company to achieve its financial goals and position itself for future growth without being burdened by excessive interest payments or equity dilution.

Advantages of Mezzanine Debt for Businesses

Mezzanine debt offers several advantages to businesses, providing them with flexibility in their capital structure and helping them avoid dilution of existing ownership. Additionally, mezzanine financing can be utilized to fund growth initiatives or acquisitions, while also offering tax advantages to businesses.

Flexibility in Capital Structure

Mezzanine debt allows businesses to structure their financing in a flexible manner, combining elements of debt and equity to suit their specific needs. This flexibility enables businesses to access capital without giving up ownership control, unlike traditional equity financing.

Avoiding Dilution of Existing Ownership

By opting for mezzanine financing, businesses can raise capital without diluting the ownership stakes of existing shareholders. This is particularly beneficial for companies looking to maintain control and decision-making power within the organization while still securing the necessary funds for growth.

Funding Growth Initiatives and Acquisitions

Mezzanine debt can be a valuable tool for businesses looking to finance expansion plans, new projects, or strategic acquisitions. This form of financing provides a cost-effective way to access capital for growth opportunities without the need to give up equity.

Tax Advantages

One of the key benefits of mezzanine financing is the potential tax advantages it offers to businesses. Interest payments on mezzanine debt are typically tax-deductible, providing businesses with a way to reduce their overall tax liability and improve cash flow.

Risks and Considerations of Mezzanine Debt

When considering mezzanine debt as a financing option, businesses should be aware of the risks involved and carefully assess the implications of taking on this type of funding.

Impact of Interest Rates and Repayment Terms

- High-interest rates: Mezzanine debt typically carries higher interest rates compared to traditional bank loans, increasing the overall cost of capital for businesses.

- Payment terms: Repayment terms for mezzanine financing can be structured as bullet payments or amortizing payments, impacting cash flow and financial flexibility.

Consequences of Defaulting on Mezzanine Debt

- Loss of control: Defaulting on mezzanine debt can lead to the dilution of ownership or even loss of control of the business to the mezzanine lenders.

- Litigation risk: Defaulting may result in legal action by the lenders, potentially leading to court proceedings and further financial strain on the business.

Strategies to Mitigate Risks

- Thorough due diligence: Conduct a comprehensive assessment of the business's financial position and growth prospects before taking on mezzanine debt.

- Proactive communication: Maintain open and transparent communication with mezzanine lenders to address any potential issues early on and prevent defaults.

- Financial planning: Develop contingency plans and ensure adequate cash reserves to meet repayment obligations and mitigate financial risks.

Final Review

In conclusion, Mezzanine Debt Explained: How Hybrid Financing Works for Businesses sheds light on a complex yet rewarding financial strategy that can benefit companies in various stages of growth. By understanding the intricacies of mezzanine debt, businesses can make informed decisions to support their expansion goals and financial objectives.

FAQ Resource

What makes mezzanine debt different from other financing options?

Mezzanine debt combines features of both debt and equity financing, offering businesses a balance of flexibility and risk compared to traditional loans or equity investments.

How can mezzanine debt help businesses avoid diluting existing ownership?

By providing a form of financing that doesn't require immediate equity dilution, mezzanine debt allows businesses to retain control while still accessing the capital needed for growth.

What are the risks associated with defaulting on mezzanine debt?

Defaulting on mezzanine debt can lead to serious consequences such as loss of control, legal action by lenders, and damage to the company's credit rating. It's crucial for businesses to carefully assess their ability to meet repayment obligations.