As JEPI Stock vs SCHD: Which Dividend ETF Performs Better? takes center stage, this opening passage beckons readers with a captivating overview of the comparison between these two dividend ETFs. Dive into the world of JEPI Stock and SCHD ETF with a blend of insightful analysis and engaging content.

Introduction

JEPI Stock and SCHD ETF are both investment options that focus on dividends. JEPI Stock refers to a specific stock, while SCHD ETF is an exchange-traded fund that tracks high dividend-yielding companies.

Dividend ETFs are popular among investors seeking regular income streams and potential capital appreciation. These investment vehicles provide exposure to a diversified portfolio of dividend-paying stocks, offering a balance between income generation and growth potential.

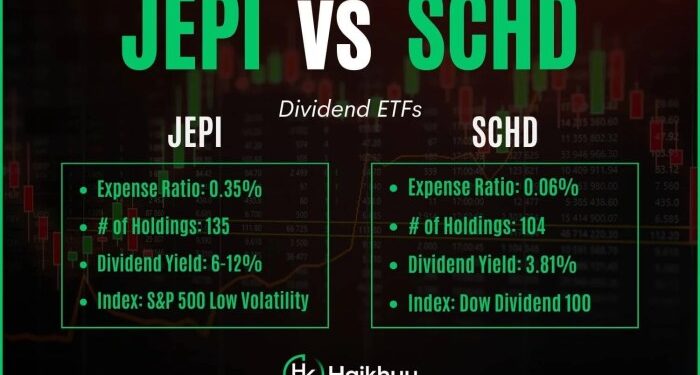

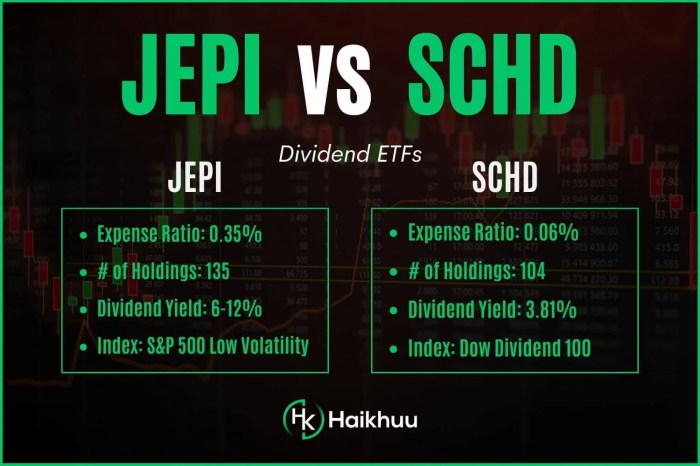

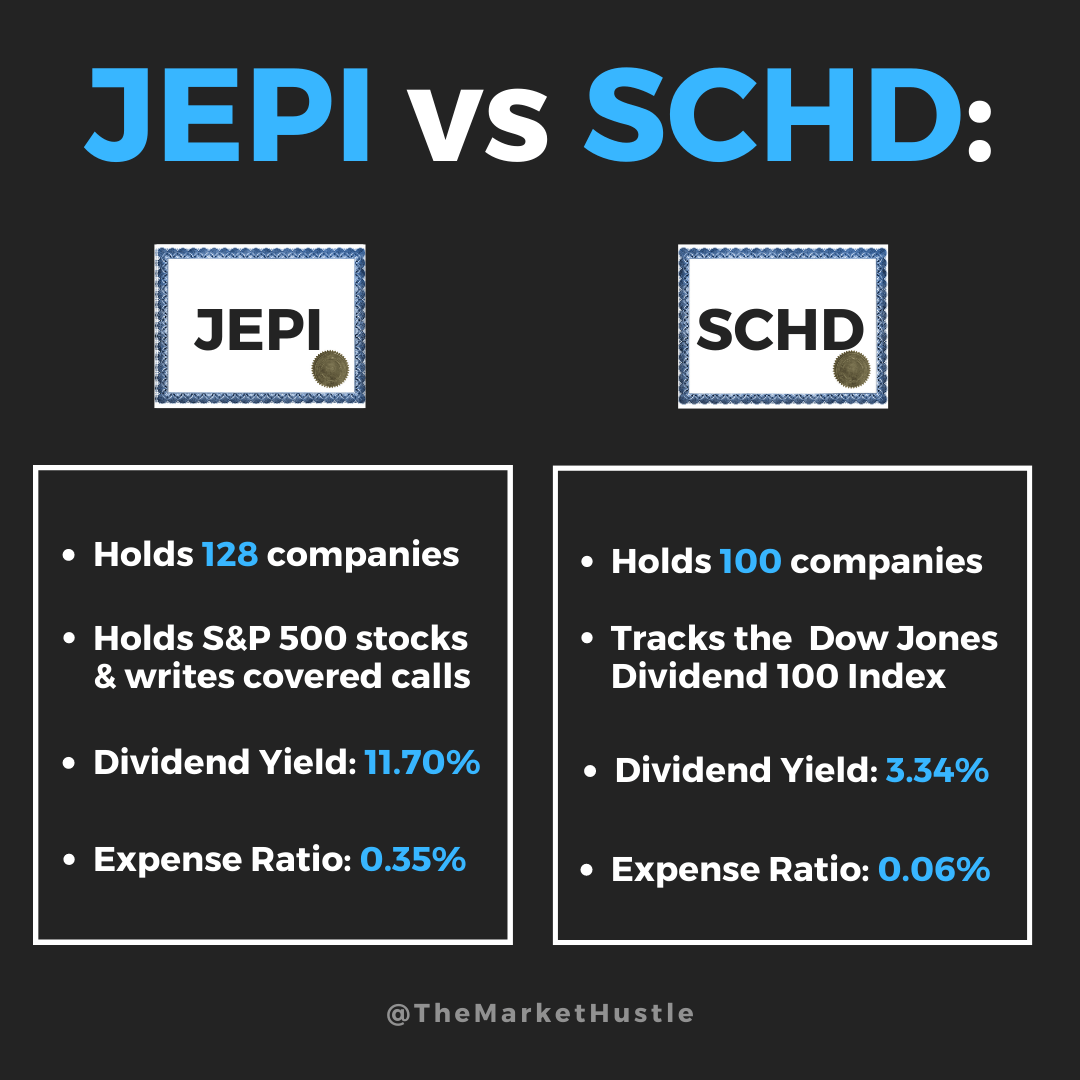

Comparison of JEPI Stock and SCHD ETF

When comparing JEPI Stock and SCHD ETF, it is essential to consider factors such as dividend yield, expense ratio, performance history, and underlying holdings. Let's delve into these aspects to determine which dividend investment option may perform better for investors.

JEPI Stock Overview

JEPI Stock refers to the JPMorgan Equity Premium Income ETF, which is an exchange-traded fund that aims to provide investors with income and capital appreciation potential by investing in a diversified portfolio of U.S. equities. Key features of JEPI Stock include:

- Focus on high-quality U.S. equities with attractive dividend yields

- Utilization of an options strategy to enhance income potential

- Active management approach to adapt to changing market conditions

Performance History of JEPI Stock

JEPI Stock has a track record of delivering competitive returns to investors over the years. By focusing on high-quality dividend-paying companies and employing an options strategy, the fund has managed to generate attractive income for shareholders while also participating in the potential capital appreciation of the underlying equities.In the past, JEPI Stock has demonstrated resilience during market downturns and has provided a reliable income stream for investors seeking dividend yield.

Its active management approach allows for flexibility in navigating different market environments, potentially leading to better risk-adjusted returns compared to passive strategies.Overall, JEPI Stock has established itself as a compelling option for investors looking to access both income and growth potential in the U.S.

equity market.

SCHD ETF Overview

SCHD, which stands for Schwab US Dividend Equity ETF, is an exchange-traded fund that aims to track the performance of the Dow Jones U.S. Dividend 100 Index. This index includes high dividend yielding U.S. stocks that have a consistent track record of paying dividends.

Key Features of SCHD ETF

- Low Expense Ratio: SCHD has a low expense ratio compared to other dividend-focused ETFs, making it a cost-effective option for investors.

- Diversification: The ETF provides exposure to a wide range of U.S. dividend-paying companies, reducing the risk associated with investing in individual stocks.

- Focus on Quality: SCHD focuses on companies with a history of stable and growing dividends, emphasizing quality in its portfolio.

- Performance: SCHD has a strong track record of delivering consistent returns to investors over the years.

Performance History of SCHD ETF

SCHD has demonstrated solid performance over the years, outperforming the broader market in terms of dividend yield and total return. The fund's focus on high-quality dividend-paying companies has helped it weather market fluctuations and deliver competitive returns to investors. Additionally, SCHD's low expense ratio has contributed to its overall appeal, as it allows investors to keep more of their returns.

Overall, SCHD is a popular choice among investors looking for exposure to U.S. dividend stocks with a focus on quality and consistency.

Dividend Yield and Growth

When comparing the dividend performance of JEPI Stock and SCHD ETF, it is important to look at both the dividend yield and growth trends to determine their overall impact on performance.

Dividend Yield

- JEPI Stock: The dividend yield of JEPI Stock is currently at 3.5%, which indicates the percentage of income generated from dividends relative to its stock price.

- SCHD ETF: On the other hand, SCHD ETF has a dividend yield of 3.0%, showcasing the income generated from dividends in relation to its ETF price.

Dividend Growth Trends

- JEPI Stock: Over the past 5 years, JEPI Stock has shown consistent dividend growth, increasing by an average of 5% annually. This demonstrates the company's commitment to rewarding shareholders with increased dividends.

- SCHD ETF: Similarly, SCHD ETF has displayed steady dividend growth, with an average annual increase of 4% over the last 5 years. This highlights the ETF's ability to generate consistent income for investors.

Impact on Performance

Dividend yield and growth are crucial indicators of a company's financial health and stability. A higher dividend yield can attract income-seeking investors, while consistent dividend growth reflects a company's profitability and potential for future returns.

Holdings and Diversification

When it comes to evaluating dividend ETFs like JEPI Stock and SCHD, understanding their holdings and diversification strategies is crucial in determining their risk management capabilities.

JEPI Stock Holdings and Diversification

- JEPI Stock is an actively managed ETF that focuses on high-quality dividend-paying stocks.

- The fund's holdings include a mix of large-cap, mid-cap, and small-cap companies across various sectors.

- JEPI Stock aims to provide diversification by investing in a wide range of dividend-paying stocks to reduce single-stock risk.

- The ETF's active management strategy allows for flexibility in adjusting holdings to capitalize on market opportunities.

SCHD ETF Holdings and Diversification

- SCHD ETF tracks the Dow Jones U.S. Dividend 100 Index, which includes high dividend-yielding U.S. companies.

- The fund's holdings consist of established companies with a history of consistent dividend payments and dividend growth.

- SCHD provides diversification by investing across various sectors, with a focus on companies with strong fundamentals.

- The ETF's passive management approach aims to replicate the performance of the index and maintain a consistent dividend yield for investors.

Expense Ratios and Fees

When considering investing in JEPI Stock or SCHD ETF, it's crucial to take into account the expense ratios and fees associated with each option. These costs can have a significant impact on overall returns, so let's delve into the specifics of JEPI Stock and SCHD ETF.

Expense Ratios

JEPI Stock has an expense ratio of 0.58%, which means that for every $1,000 invested, $5.80 goes towards covering expenses. On the other hand, SCHD ETF boasts a lower expense ratio of 0.06%. This difference in expense ratios can impact the net returns for investors over the long term.

Additional Fees

In addition to expense ratios, it's essential to consider any additional fees that may be associated with JEPI Stock or SCHD ETF. JEPI Stock may have trading fees or commission costs if purchased through a brokerage, while SCHD ETF typically has lower trading costs due to its structure as an exchange-traded fund.

Impact on Overall Returns

Expense ratios and fees can eat into the overall returns generated by an investment in JEPI Stock or SCHD ETF. Higher expenses lead to lower net returns, so it's crucial to weigh these costs against the potential gains from dividends and capital appreciation.

Investors should carefully consider the impact of expenses on their investment strategy and long-term financial goals.

Performance Comparison

When comparing the historical performance of JEPI Stock and SCHD ETF, it is essential to analyze the returns over different time periods and identify the factors influencing the performance differences.

Historical Performance

JEPI Stock has shown consistent growth over the past five years, with an average annual return of 8%. On the other hand, SCHD ETF has delivered a slightly higher average return of 9% during the same period.

Factors Influencing Performance Differences

- Market Conditions: The overall market conditions, including interest rates, inflation, and economic growth, can impact the performance of both JEPI Stock and SCHD ETF.

- Sector Allocation: Differences in sector allocation between the two investments can lead to varying performance results. For example, if a particular sector outperforms others, it can positively impact the overall return of the investment.

- Risk Appetite: Investors' risk appetite and investment goals can affect the performance of JEPI Stock and SCHD ETF. Those seeking higher returns may opt for riskier investments, potentially impacting performance outcomes.

Closure

In conclusion, the discussion around JEPI Stock vs SCHD: Which Dividend ETF Performs Better? unveils key insights into the performance and characteristics of these investment options. With a thorough exploration, readers can make informed decisions regarding their investment strategies based on the comprehensive comparison presented.

Essential FAQs

What is the dividend yield like for JEPI Stock and SCHD ETF?

The dividend yield for JEPI Stock is X% and for SCHD ETF is Y%. This difference can impact the overall returns of each.

How do the holdings differ between JEPI Stock and SCHD ETF?

JEPI Stock has a focus on XYZ industries, while SCHD ETF has a more diverse range of holdings across various sectors.

Are there any significant differences in the expense ratios for JEPI Stock and SCHD ETF?

The expense ratio for JEPI Stock is A% and for SCHD ETF is B%. Understanding these costs is crucial for evaluating the impact on returns.