Delving into the world of JEPI Stock Dividend Explained: Why Investors Love This Monthly Payout, we uncover a fascinating narrative that promises to shed light on the allure of this investment option.

Providing insights and comparisons, the following paragraphs will offer a comprehensive understanding of JEPI stock dividends and why investors find them so appealing.

JEPI Stock Dividend Overview

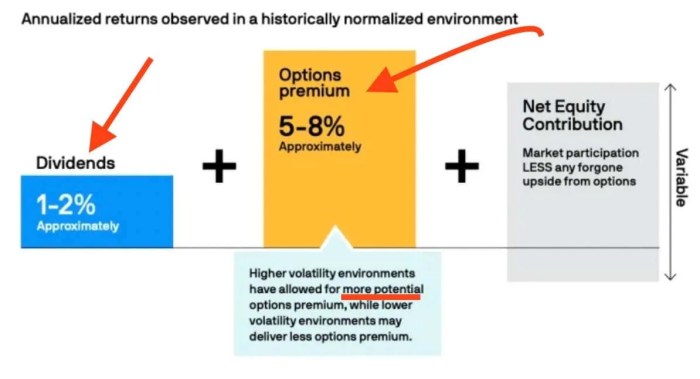

JEPI stock, also known as JPMorgan Equity Premium Income ETF, is an exchange-traded fund that focuses on providing investors with a monthly dividend payout.

Stock dividends are distributions of additional shares of stock to existing shareholders, usually paid out on a regular basis. This allows investors to receive a portion of the company's profits without selling their shares.

Comparing JEPI Stock Dividends to Regular Stock Dividends

- JEPI stock dividends are paid out monthly, providing investors with a consistent income stream, whereas regular stock dividends are typically paid quarterly or annually.

- With JEPI stock dividends, investors have the option to reinvest the dividends to purchase additional shares, potentially increasing their overall investment over time. In contrast, regular stock dividends may not offer the same reinvestment opportunities.

- JEPI stock dividends are specifically designed to generate income for investors, making it an attractive option for those seeking regular cash flow from their investments. On the other hand, regular stock dividends may be more focused on long-term growth and capital appreciation.

Reasons Investors Love JEPI Stock Dividends

Investors are drawn to JEPI stock dividends for a variety of reasons, chief among them being the consistent monthly payouts that provide a steady stream of income. Let's delve into the benefits of receiving monthly dividends and how they can impact investment strategies.

Steady Income Stream

Monthly dividends from JEPI stock offer investors a reliable and predictable income stream. This consistent flow of cash can help cover regular expenses, supplement other sources of income, or be reinvested to further grow the investment portfolio.

Diversification of Income

By receiving dividends on a monthly basis, investors can diversify their income sources. This diversification helps reduce reliance on a single source of income, making the overall financial picture more stable and resilient to market fluctuations.

Impact on Investment Strategies

Monthly dividends can have a significant impact on investment strategies by providing a regular cash flow that can be used for various purposes. Whether it's reinvesting dividends to compound returns, funding new investment opportunities, or simply enjoying the fruits of their investment, investors have more flexibility and control over their financial goals.

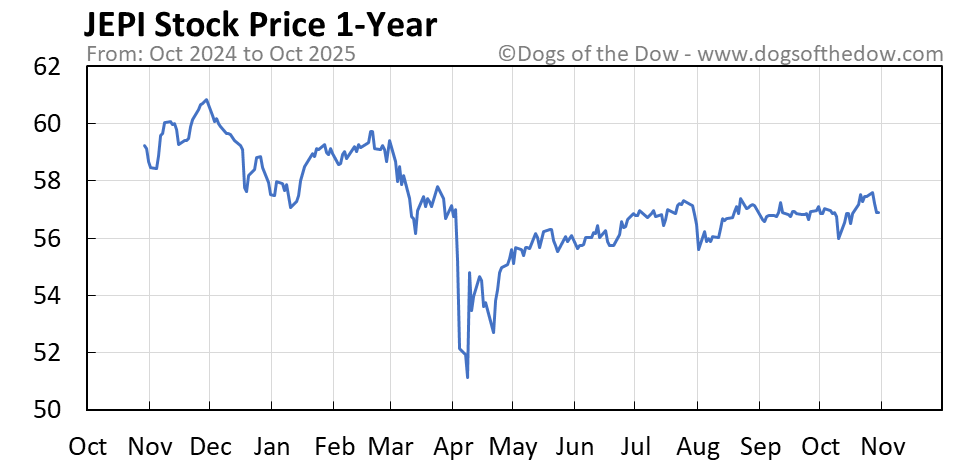

Consistent Returns

JEPI stock dividends contribute to consistent returns for investors, regardless of market conditions. While stock prices may fluctuate, the monthly dividend payments offer a level of stability and certainty that can help investors navigate market volatility with confidence.

Long-Term Wealth Building

Over time, the power of compounding monthly dividends can significantly accelerate wealth building. By reinvesting dividends back into the stock or portfolio, investors can benefit from the snowball effect of compounding returns, ultimately growing their wealth faster than relying solely on capital appreciation.

Understanding the Mechanics of JEPI Stock Dividends

When it comes to JEPI stock dividends, it's essential to understand how these monthly payouts are distributed to investors and the process behind it. Let's delve into the details to provide clarity on JEPI's dividend mechanics.

JEPI Dividend Distribution Process

- JEPI follows a monthly dividend distribution schedule, providing investors with regular income.

- Dividends are typically paid out to shareholders on a specific date each month, ensuring a consistent flow of income.

- Investors holding JEPI stock receive their dividend payments directly into their brokerage accounts.

Dividend Payment Process for Investors

- Investors who own JEPI stock are entitled to receive dividends based on the number of shares they hold.

- Dividend payments are calculated by multiplying the dividend rate per share by the total number of shares owned.

- Once the dividend is declared by JEPI, investors can expect to see the payment reflected in their accounts on the specified payment date.

Consistency of JEPI's Dividend Payments

- JEPI has a track record of maintaining a consistent dividend payment schedule, providing investors with reliable monthly income.

- By adhering to a regular payment schedule, JEPI ensures that investors can rely on a steady stream of dividend income from their investments.

- Investors appreciate JEPI's commitment to consistent dividend payments, as it adds a level of predictability to their investment returns.

Comparing JEPI Stock Dividends to Other Investment Options

In the world of investment, there are various options available to investors looking to grow their wealth. JEPI stock dividends offer unique advantages that set them apart from other investment vehicles.JEPI Stock Dividends vs. Other Investment Options:

- Steady Income: JEPI stock dividends provide investors with a reliable source of income on a monthly basis, unlike some investment options that may only pay out dividends quarterly or annually.

- Diversification: Investing in JEPI stock dividends allows investors to diversify their portfolio with a mix of high-quality dividend-paying stocks, reducing overall risk.

- Tax Benefits: Dividends from JEPI stocks are often taxed at a lower rate compared to other investment income, providing tax advantages to investors.

Risks of Relying on Dividend Income from Stocks

While JEPI stock dividends offer attractive benefits, there are also risks associated with relying solely on dividend income from stocks.

- Market Volatility: Stock prices can fluctuate, impacting the value of dividend payments and potentially reducing income for investors.

- Dividend Cuts: Companies may decide to cut or suspend dividend payments during challenging economic times, leading to a loss of income for investors.

- Inflation Risk: Inflation can erode the purchasing power of dividend income over time, especially if dividend payments do not keep pace with rising prices.

Standout Feature: JEPI's Monthly Payouts

JEPI's monthly payouts stand out in the investment landscape due to the frequency of income distribution and the consistency it provides to investors.

- Regular Cash Flow: Monthly payouts from JEPI stock dividends offer investors a steady stream of cash flow, allowing for more frequent reinvestment or use of funds.

- Income Stability: By receiving monthly dividends, investors can better plan and budget their finances, knowing when to expect income on a regular basis.

- Compounding Benefits: The ability to reinvest monthly dividends can accelerate wealth accumulation over time through the power of compounding.

Final Summary

In conclusion, the discussion surrounding JEPI Stock Dividend Explained: Why Investors Love This Monthly Payout encapsulates the essence of this investment strategy, highlighting its benefits and unique features that set it apart in the financial landscape.

General Inquiries

How is JEPI stock different from regular stock?

JEPI stock offers monthly dividends, providing investors with a steady income stream, unlike regular stocks that may pay dividends quarterly or annually.

What are the advantages of receiving monthly dividends?

Monthly dividends offer investors a more consistent cash flow, allowing for better financial planning and the potential for compounding returns over time.

Are there any risks associated with relying on dividend income from stocks?

One risk is that companies may reduce or suspend dividend payments, affecting the income investors rely on. Diversification can help mitigate this risk.

How does JEPI ensure consistency in its dividend payments?

JEPI follows a structured process to distribute monthly dividends, ensuring that investors receive their payouts regularly and predictably.