As Business Debt Consolidation: Strategies for Small Enterprises to Regain Stability takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this article, we will delve into the key strategies, benefits, steps, and alternative financing options related to business debt consolidation for small enterprises.

Strategies for Business Debt Consolidation

Debt consolidation is a financial strategy that involves combining multiple debts into a single, more manageable loan with better terms. This can help businesses streamline their debt repayment process and reduce overall interest costs.

Common Challenges in Managing Debt for Small Enterprises

Small enterprises often face challenges in managing their debt effectively, which can hinder their financial stability and growth. Some common challenges include:

- Limited cash flow: Small businesses may struggle with inconsistent cash flow, making it difficult to meet debt obligations on time.

- High-interest rates: Small enterprises may have taken on debt with high-interest rates, leading to increased overall debt costs.

- Lack of financial expertise: Small business owners may lack the financial knowledge to effectively manage their debt and explore debt consolidation options.

Successful Debt Consolidation Strategies for Small Businesses

Despite these challenges, small businesses can implement successful debt consolidation strategies to regain stability:

- Negotiating with creditors:Small business owners can negotiate with creditors to lower interest rates or extend repayment terms, making debt more manageable.

- Consolidation loans:Taking out a consolidation loan to pay off multiple high-interest debts can help simplify repayment and reduce overall interest costs.

- Seeking professional advice:Small enterprises can benefit from seeking guidance from financial advisors or debt consolidation experts to explore the best options for their specific situation.

Benefits of Debt Consolidation for Small Enterprises

Debt consolidation can offer numerous advantages for small businesses looking to regain financial stability and improve their cash flow and profitability.

Reduced Interest Rates

Debt consolidation often involves combining multiple high-interest debts into a single loan with a lower interest rate, helping small enterprises save money on interest payments over time.

Lower Monthly Payments

By consolidating business debt, small enterprises can potentially reduce their monthly payments, making it easier to manage their cash flow and meet financial obligations without straining their budget.

Improved Credit Score

Consolidating debt can also help small businesses improve their credit score by making timely payments on a single loan rather than juggling multiple debts. A higher credit score can lead to better financing options and lower interest rates in the future.

Streamlined Debt Management

With debt consolidation, small enterprises can simplify their debt management process by having only one monthly payment to focus on, reducing the chances of missing payments or incurring additional fees.

Enhanced Financial Stability

Overall, debt consolidation can help small businesses regain financial stability by providing a structured repayment plan, reducing financial stress, and creating a clearer path towards debt-free operations.

Steps to Implement Debt Consolidation

Implementing debt consolidation for your small business can be a smart move to regain financial stability. Here is a step-by-step guide to help you navigate through the process effectively.

Create a Realistic Budget

Before starting the debt consolidation process, it is crucial to create a realistic budget. This will help you understand your current financial situation, identify areas where you can cut costs, and determine how much you can allocate towards debt repayment.

Negotiate with Creditors

When consolidating your debts, it's important to negotiate with your creditors to achieve favorable consolidation terms. Here are some tips to help you negotiate effectively:

- Communicate openly with your creditors about your financial situation and your intention to consolidate your debts.

- Try to negotiate lower interest rates or extended payment terms to make repayment more manageable.

- Consider seeking the help of a debt consolidation company or a financial advisor to assist you in negotiations.

- Be persistent and patient during the negotiation process, as it may take time to reach an agreement that works for both parties.

Alternative Financing Options for Debt Consolidation

When small businesses are looking to consolidate their debt, they often turn to alternative financing options to help ease their financial burden and regain stability. These options can vary in terms of eligibility requirements, interest rates, and repayment terms, so it's crucial for businesses to carefully evaluate each option to determine the best fit for their specific needs.

1. Business Loans

Business loans are a common choice for debt consolidation as they provide a lump sum of money that can be used to pay off existing debts. These loans typically have fixed interest rates and repayment terms, making it easier for businesses to budget and plan for repayment.

However, businesses need to meet certain criteria to qualify for a loan, and failure to repay can result in severe consequences.

2. Lines of Credit

Lines of credit offer businesses the flexibility to borrow funds as needed, up to a predetermined limit. This option can be beneficial for businesses with fluctuating cash flow or those looking to consolidate smaller amounts of debt over time. While lines of credit offer more flexibility than loans, they often come with variable interest rates and may require collateral to secure the credit line.

3. Invoice Financing

Invoice financing allows businesses to borrow money against outstanding invoices, providing them with immediate cash flow to address their debt obligations. This option can be particularly useful for businesses with significant accounts receivable but limited working capital. However, invoice financing can be costly, with fees and interest rates that can add up over time.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms connect businesses seeking financing with individual investors willing to lend money. This option can offer competitive interest rates and more flexible terms compared to traditional financial institutions. However, businesses need to be aware of the risks involved, as peer-to-peer lending may not have the same level of regulatory oversight as traditional lenders.

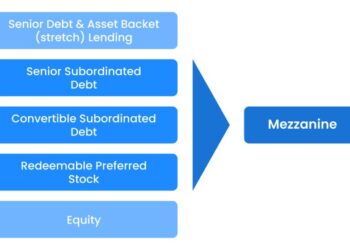

5. Asset-Based Loans

Asset-based loans allow businesses to borrow money using their assets, such as inventory, equipment, or real estate, as collateral. This option can be beneficial for businesses that have valuable assets but may not qualify for traditional financing. However, failure to repay an asset-based loan could result in the loss of the collateral, so businesses need to carefully assess their ability to meet repayment obligations.

Concluding Remarks

In conclusion, Business Debt Consolidation: Strategies for Small Enterprises to Regain Stability offers a comprehensive guide for businesses looking to manage and overcome debt challenges effectively. By implementing these strategies, small enterprises can pave the way for financial stability and long-term success.

Popular Questions

What are the common challenges faced by small enterprises in managing debt?

Small enterprises often struggle with high-interest rates, multiple debt sources, and inconsistent cash flow, making it challenging to keep up with debt payments. Implementing debt consolidation strategies can help alleviate these issues.

How can small businesses negotiate with creditors for favorable consolidation terms?

Small businesses can negotiate with creditors by presenting a detailed repayment plan, demonstrating commitment to debt repayment, and seeking professional advice if needed. Clear communication and transparency are key in these negotiations.

What are the advantages of consolidating business debt?

Consolidating business debt can lead to lower interest rates, simplified payment schedules, improved cash flow, and a clear path to debt repayment. It can also help businesses avoid bankruptcy and regain financial stability.