When comparing Revenue Based Financing to Traditional Loans for startups, it's essential to understand the intricacies of each funding option. From the structure to the repayment terms, these financing methods offer distinct advantages and considerations for entrepreneurs looking to secure capital.

Let's delve into the nuances of Revenue Based Financing and Traditional Loans to determine which option may be more suitable for startup ventures.

Exploring the eligibility criteria, application processes, funding amounts, and other key aspects will provide valuable insights for startups navigating the complex landscape of financing.

Introduction

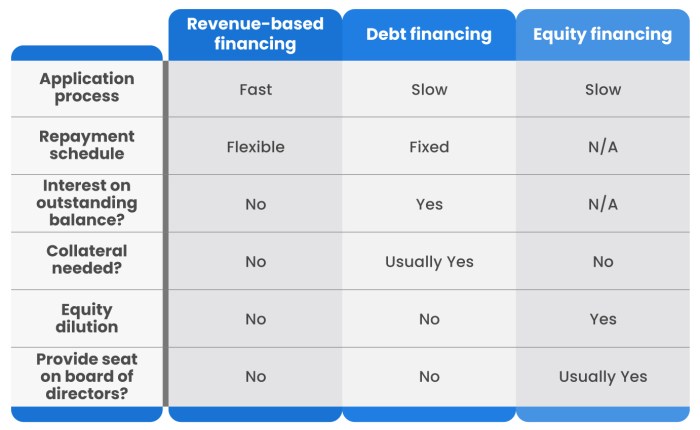

Revenue Based Financing (RBF) and Traditional Loans are two common sources of funding for startups with distinct structures and repayment methods. RBF involves receiving funding in exchange for a percentage of future revenue, while Traditional Loans require repayment of a fixed amount plus interest over a set period.

Differences in Structure and Repayment

- RBF: In RBF, startups receive funding in exchange for a percentage of their future revenue. This means that repayment fluctuates based on revenue performance, making it more flexible compared to Traditional Loans.

- Traditional Loans: With Traditional Loans, startups borrow a fixed amount and are required to repay this amount plus interest over a predetermined period, regardless of revenue fluctuations. This can create a more predictable repayment structure but may also be more rigid for startups.

Eligibility Criteria

Revenue Based Financing and Traditional Loans have different eligibility criteria that startups need to meet in order to secure funding. Let's take a closer look at the typical requirements for each option.

Revenue Based Financing

Revenue Based Financing, also known as revenue-based loans or revenue-based funding, is a type of financing where a company receives funds in exchange for a percentage of future revenue. The eligibility criteria for Revenue Based Financing usually include:

- Minimum monthly revenue threshold

- Stable revenue history

- Proven business model

- Positive growth trajectory

- Shorter time in business compared to traditional loans

- Less emphasis on credit score

Revenue Based Financing focuses more on the potential of the business to generate revenue in the future rather than the credit history of the founders.

Traditional Loans

Traditional Loans, on the other hand, have a different set of requirements that are typically more stringent compared to Revenue Based Financing. The eligibility criteria for Traditional Loans often include:

- High credit score

- Collateral or personal guarantee

- Detailed business plan

- Longer time in business

- Financial statements and tax returns

- Fixed monthly payments

Traditional Loans rely heavily on the creditworthiness of the borrower, collateral, and a solid business plan to assess the risk of lending.

Application Process

When it comes to applying for funding, whether through Revenue Based Financing or Traditional Loans, the application process plays a crucial role in determining the ease and efficiency of securing the funds needed for a startup.

Revenue Based Financing

- Submit an application: Start by filling out an application form provided by the Revenue Based Financing provider. This form typically requires details about your business, revenue projections, and other financial information.

- Review and Due Diligence: The provider will review your application and conduct due diligence to assess the viability of your business and its revenue potential. This may involve requesting additional documentation or information.

- Offer and Terms: If your application is approved, you will receive an offer detailing the amount of funding, repayment terms, and revenue share percentage. Review these terms carefully before accepting the offer.

- Disbursement: Once you accept the offer, the funding will be disbursed to your business account, and the agreed-upon revenue share will commence as per the terms of the agreement.

Traditional Loans

- Prepare Documentation: Gather all necessary documents such as business plans, financial statements, tax returns, and other relevant information required by the lender.

- Application Submission: Fill out the loan application form provided by the lender and submit it along with the required documentation for review.

- Underwriting Process: The lender will assess your creditworthiness, business performance, and ability to repay the loan based on the information provided. This may involve a credit check and evaluation of collateral.

- Loan Approval and Terms: If your application is approved, you will receive a loan offer outlining the approved amount, interest rate, repayment schedule, and any other terms and conditions.

- Funding Disbursement: Upon accepting the loan offer, the funds will be disbursed to your business account, and you will be required to make regular repayments as per the agreed-upon terms.

Funding Amount and Repayment

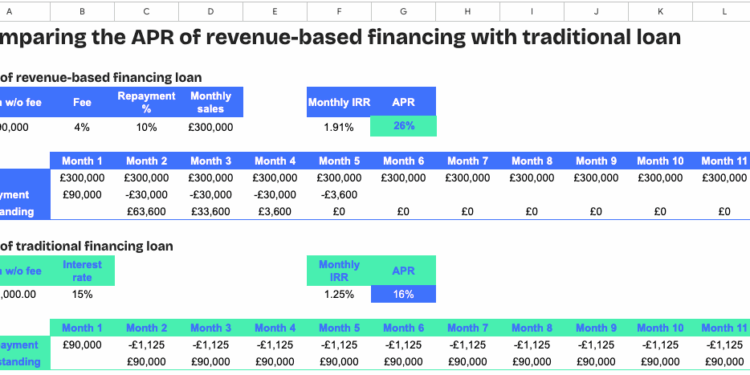

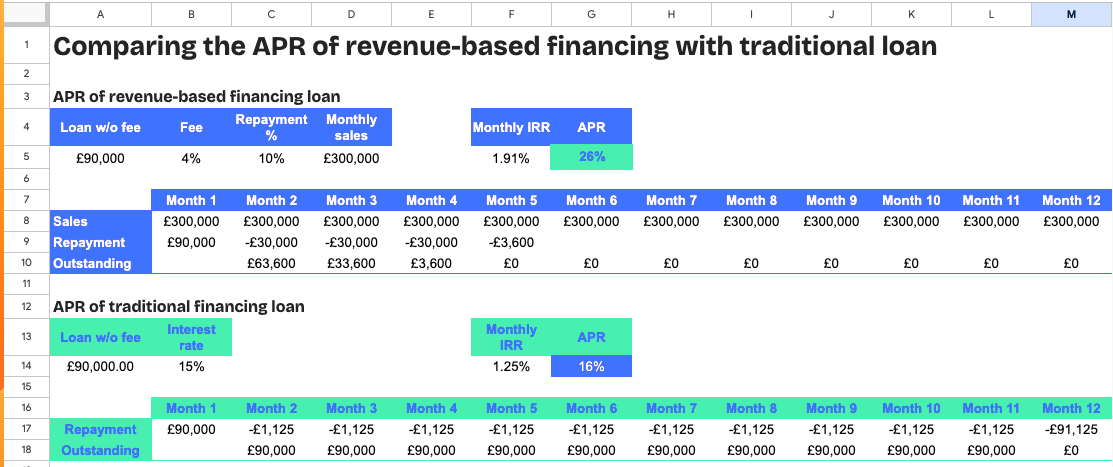

When it comes to funding amounts and repayment, Revenue Based Financing and Traditional Loans offer different structures that can impact startups in various ways.

Typical Funding Amounts in Revenue Based Financing

- Revenue Based Financing typically offers funding amounts ranging from $50,000 to $2 million, depending on the startup's monthly revenue.

- The funding amount is usually a percentage of the startup's monthly revenue, with repayment tied to future revenue streams.

- Startups can access capital without giving up equity, making it an attractive option for businesses looking to grow without diluting ownership.

Repayment Process in Traditional Loans

- Traditional Loans involve borrowing a fixed amount from a lender, which needs to be repaid in regular installments over a set period, typically with interest.

- Startups may face challenges with repayment, especially if the business experiences fluctuations in revenue or unexpected expenses.

- Defaulting on a Traditional Loan can have serious consequences, such as damaging the startup's credit score and affecting future borrowing opportunities.

Speed of Funding

When it comes to funding, the speed at which startups receive the necessary capital can make a significant difference in their success. Let's examine how Revenue Based Financing compares to Traditional Loans in terms of funding speed.

Revenue Based Financing

Revenue Based Financing typically offers a faster funding process compared to Traditional Loans. This is because RBF providers base their funding decisions on the company's revenue and growth potential rather than extensive credit checks and collateral requirements. As a result, startups can receive funds in a matter of weeks, allowing them to quickly inject capital into their operations and fuel growth.

Traditional Loans

On the other hand, Traditional Loans often involve a lengthier approval process that can take several months. Banks and financial institutions typically require startups to provide extensive documentation, undergo credit checks, and offer collateral to secure the loan. This can result in a longer wait time for funding approval, which may hinder startups from seizing time-sensitive opportunities or addressing urgent financial needs.Overall, Revenue Based Financing offers a quicker funding alternative for startups compared to Traditional Loans, enabling them to access capital faster and capitalize on growth opportunities swiftly.

Flexibility in Repayment

Revenue Based Financing offers a unique flexibility in repayment terms that can be beneficial for startups with fluctuating revenue streams. Unlike traditional loans that require a fixed monthly payment, Revenue Based Financing allows for repayments based on a percentage of monthly revenue, which means payments increase or decrease along with the company's revenue.

Revenue Based Financing

- Repayment tied to revenue: The amount to be repaid each month is directly linked to the company's revenue, making it more manageable during slow months.

- Flexible payment schedule: Startups have the flexibility to adjust payments based on their cash flow, allowing for more breathing room during challenging times.

- No fixed deadlines: There are no strict deadlines for repayment, as payments are directly tied to revenue, giving companies more leeway in managing their finances.

Traditional Loans

- Fixed monthly payments: Traditional loans require a fixed monthly payment regardless of the company's revenue, which can be challenging for startups with irregular income.

- Rigid payment schedule: Companies must adhere to a strict payment schedule, which may lead to financial strain during slow periods.

- Potential penalties: Missing payments or not adhering to the repayment schedule can result in penalties or damage to the company's credit score, adding extra pressure on startups.

Impact on Equity Ownership

Revenue Based Financing and Traditional Loans have different impacts on the equity ownership of startups. Let's explore how each option affects the ownership structure.

Revenue Based Financing

Revenue Based Financing allows startups to secure funding without giving up equity. Instead of taking a stake in the company, the investors receive a percentage of the company's monthly revenue until a predetermined amount is repaid. This means that startups can maintain full ownership and control over their business while still accessing the needed capital.

Traditional Loans

On the other hand, Traditional Loans usually require collateral or personal guarantees, putting the assets of the business or the personal assets of the founders at risk. Additionally, traditional lenders may also require equity ownership or a stake in the company as part of the loan agreement.

This can result in dilution of ownership for the founders and may impact decision-making processes within the startup.

Risk Assessment

When it comes to funding options for startups, risk assessment plays a crucial role in determining the viability and sustainability of the business. Both Revenue Based Financing and Traditional Loans involve evaluating the risks associated with lending money to startups, but the approach may vary between the two.

Risk Assessment in Revenue Based Financing

In Revenue Based Financing, the risk assessment focuses heavily on the startup's revenue projections and historical performance. Lenders analyze the consistency and growth potential of the company's revenue streams to determine the likelihood of repayment. Factors such as customer retention, market demand, and industry trends also play a significant role in assessing the risk involved.

Additionally, lenders may consider the overall business model and management team to gauge the startup's ability to meet its financial obligations.

- Revenue projections and historical performance are key factors in risk assessment.

- Consistency and growth potential of revenue streams are analyzed.

- Customer retention, market demand, and industry trends are considered.

- Business model and management team are evaluated for financial capability.

Risk Assessment in Traditional Loans

Traditional Loans typically involve a more standardized approach to risk assessment, focusing on the startup's credit history, collateral, and financial statements. Lenders rely heavily on credit scores, assets, and personal guarantees to mitigate the risk of default. While revenue projections and business potential may also be considered, the emphasis is often placed on the startup's ability to provide security against the loan amount.

- Credit history, collateral, and financial statements are primary considerations.

- Credit scores, assets, and personal guarantees play a significant role in risk mitigation.

- Emphasis on providing security against the loan amount.

Last Recap

In conclusion, the decision between Revenue Based Financing and Traditional Loans hinges on various factors such as funding needs, repayment preferences, and long-term sustainability. By weighing the pros and cons of each option, startups can make informed choices that align with their financial goals and growth strategies.

Essential FAQs

Is Revenue Based Financing or Traditional Loans better for startups seeking flexible repayment terms?

Revenue Based Financing typically offers more flexibility in repayment terms compared to Traditional Loans, making it a preferred option for startups with fluctuating cash flows.

How does Equity Ownership differ between Revenue Based Financing and Traditional Loans?

Revenue Based Financing usually does not dilute equity ownership as much as Traditional Loans, allowing startups to retain more control over their business.

Which funding option provides quicker access to capital: Revenue Based Financing or Traditional Loans?

Revenue Based Financing often provides faster funding compared to Traditional Loans, which involve a more lengthy approval and disbursement process.