Debt Financing Examples: How Companies Raise Capital Smartly sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

Exploring the various facets of debt financing, this discussion delves into the strategies, case studies, risks, and challenges faced by companies in raising capital through this method.

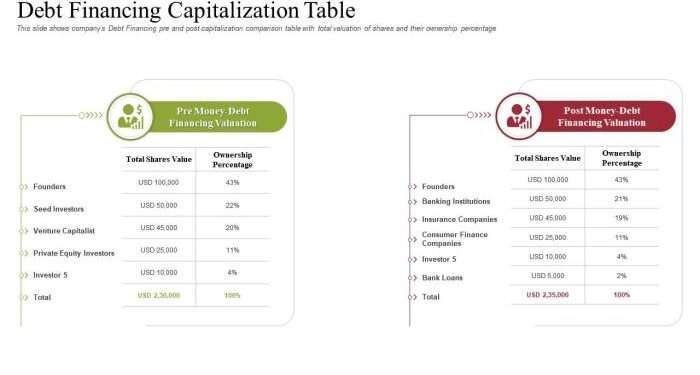

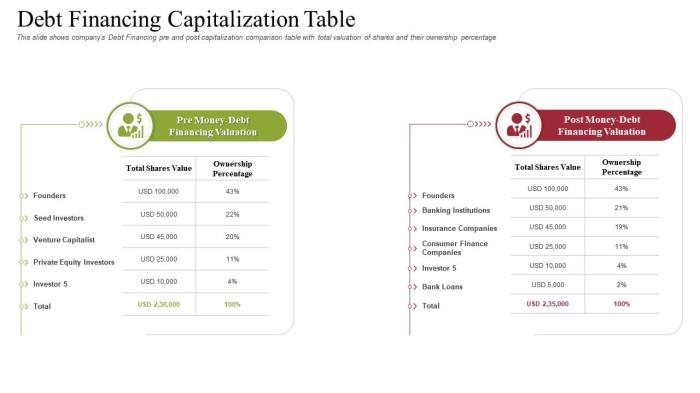

Overview of Debt Financing

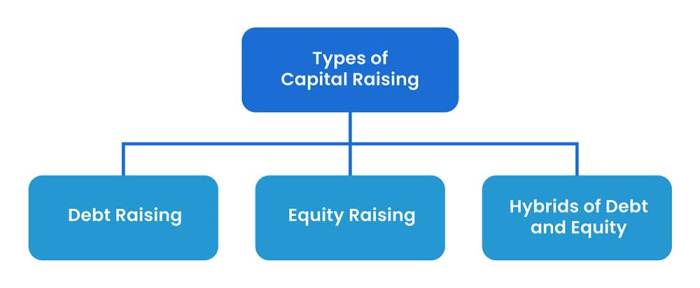

Debt financing is a method used by companies to raise capital by borrowing funds from external sources, such as banks or bondholders, with the promise of repayment with interest. This differs from equity financing, where companies raise funds by selling ownership stakes in the business.

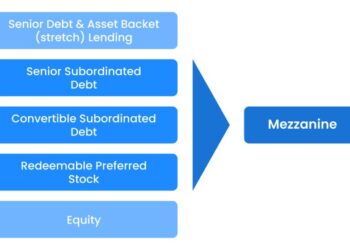

Types of Debt Financing Instruments

- Bank Loans: Companies can secure loans from financial institutions to finance operations, expansion, or other needs.

- Corporate Bonds: Companies issue bonds to investors as a form of debt, promising regular interest payments and repayment of the principal amount at maturity.

- Lines of Credit: Companies can establish lines of credit with banks, allowing them to borrow funds up to a specified limit as needed.

Advantages and Disadvantages of Debt Financing

Debt financing offers several advantages, such as:

- Interest payments on debt are tax-deductible, reducing the company's taxable income.

- Debt does not dilute ownership as equity financing does, allowing existing shareholders to retain control.

- Debt can be less expensive than equity financing, especially in times of low interest rates.

However, there are also disadvantages to using debt to raise capital:

- High levels of debt can increase financial risk and lead to financial distress if the company is unable to meet its debt obligations.

- Debt comes with the obligation to make regular interest payments, which can strain cash flow, especially in times of economic downturn.

- Defaulting on debt payments can damage the company's credit rating and make it more difficult to secure financing in the future.

Debt Financing Strategies

When it comes to debt financing, companies employ various strategies to raise capital effectively and manage their financial resources. These strategies are crucial in determining the optimal mix of debt and equity financing, and are heavily influenced by prevailing economic conditions.

Leveraging Debt Financing Effectively

Companies can leverage debt financing effectively by:

- Issuing bonds: Companies can raise capital by issuing bonds to investors, promising to repay the principal amount with interest at a later date.

- Bank loans: Securing loans from financial institutions can provide companies with immediate capital to fund their operations or expansion plans.

- Convertible debt: Offering convertible debt allows companies to raise funds with the option for investors to convert the debt into equity in the future.

Determining the Optimal Mix of Debt and Equity Financing

Companies determine the optimal mix of debt and equity financing by considering factors such as:

- Cost of capital: Comparing the cost of debt and equity to find the most cost-effective financing option.

- Risk tolerance: Assessing the company's risk tolerance to determine the appropriate level of debt that can be comfortably managed.

- Growth opportunities: Evaluating growth prospects to decide on the proportion of debt and equity needed to fuel expansion.

Influence of Economic Conditions on Debt Financing Decisions

Economic conditions play a significant role in shaping debt financing decisions, as companies adjust their strategies based on factors like:

- Interest rates: Fluctuations in interest rates can impact the cost of debt financing, leading companies to reevaluate their borrowing options.

- Market conditions: Changes in market conditions can affect investor sentiment and the availability of financing sources for companies.

- Inflation rates: Companies consider inflation rates when deciding on debt financing, as high inflation can erode the value of borrowed funds over time.

Case Studies of Successful Debt Financing

Debt financing has been a crucial strategy for many companies looking to raise capital smartly. Let's dive into specific examples of companies that have effectively utilized debt financing to support their growth and operations.

Apple Inc.

Apple Inc. is a prime example of a company that has strategically leveraged debt financing to fuel its expansion and innovation efforts. By issuing corporate bonds at low interest rates, Apple has been able to raise significant funds without diluting existing shareholder ownership.

This approach has allowed Apple to invest in research and development, acquire new technologies, and expand its product offerings, leading to sustained growth and profitability.

Amazon.com

Amazon.com is another success story in the realm of debt financing. The e-commerce giant has used a combination of bonds and loans to finance its ambitious expansion plans, including acquisitions like Whole Foods Market and investments in new technologies like artificial intelligence and cloud computing.

By structuring its debt financing arrangements wisely, Amazon has been able to fund its growth initiatives while maintaining a strong balance sheet and credit rating.

Netflix Inc.

Netflix Inc. is a notable example of a company that has utilized debt financing to support its content production and global expansion efforts. Through issuing bonds and loans, Netflix has raised capital to invest in original programming, expand its subscriber base, and enter new markets around the world.

Despite carrying a significant amount of debt on its balance sheet, Netflix's strategic approach to debt financing has fueled its rapid growth and dominance in the streaming industry.

Conclusion

These case studies highlight how companies like Apple, Amazon, and Netflix have effectively utilized debt financing to drive their growth and innovation agendas. By carefully structuring their debt arrangements and tapping into the capital markets, these companies have been able to achieve their strategic objectives while maximizing shareholder value.

Risks and Challenges of Debt Financing

Debt financing can offer significant benefits to companies, but it also comes with its own set of risks and challenges that need to be carefully managed. Understanding these potential pitfalls is crucial for businesses looking to raise capital through debt.Some common risks associated with debt financing include:

- Interest rate risk: Fluctuations in interest rates can significantly impact the cost of servicing debt for companies.

- Liquidity risk: Companies may face challenges in meeting their debt obligations if they experience cash flow issues.

- Refinancing risk: Difficulty in refinancing existing debt can lead to financial strain for businesses.

- Default risk: Failing to meet debt payments can result in severe consequences, such as bankruptcy.

To mitigate these risks, companies can employ various strategies:

- Diversification of funding sources to reduce reliance on a single type of debt.

- Regularly monitoring and managing cash flow to ensure timely debt payments.

- Implementing hedging strategies to offset interest rate risks.

- Maintaining a good credit rating to access favorable borrowing terms.

In addition to risks, companies may also face challenges when managing debt obligations:

- Balancing debt levels with equity to maintain a healthy capital structure.

- Navigating complex debt agreements and covenants that come with borrowing.

- Anticipating and planning for changing market conditions that could impact debt repayment.

Closure

In conclusion, Debt Financing Examples: How Companies Raise Capital Smartly sheds light on the intricate world of financial decisions, showcasing the importance of smart capital-raising practices for sustainable growth and success.

Essential Questionnaire

What are some common types of debt financing instruments used by companies?

Companies often utilize bonds, loans, and lines of credit as common types of debt financing instruments.

How do companies determine the optimal mix of debt and equity financing?

Companies typically consider factors such as cost of capital, risk tolerance, and financial flexibility when determining the optimal mix of debt and equity financing.

What are some common risks associated with debt financing for companies?

Common risks include high interest payments, potential for default, and constraints on future cash flows.